pru·dent /ˈproodnt/

adjective

- discreet or cautious in managing one’s activities; circumspect

- practical and careful in providing for the future

- exercising good judgment or common sense

Unique times create unique opportunities. We believe that a long term vision and asset allocation are prudent and work over time. There are normally traditional truths that define the prudent investor.

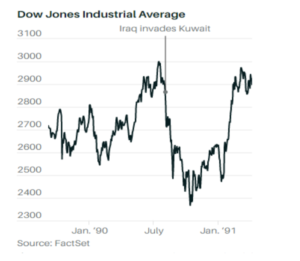

A downturn in the markets typically allows for an opportunity to purchase stocks and positions at an advantageous price point. Historically the markets have shown us that after a period of significant downturn the opportunity arises for gains to be made in the four-week and six-month periods following the large dips. “The coronavirus is reminiscent of 1990 in terms of stock-market effect,” wrote Stifel head of institutional equity strategy Barry Bannister, referring to the year Iraq invaded Kuwait. “A short, sharp, out-of-the blue shock that, after the fact, proved to have been painful, but economically overrated.” *

While it is impossible to determine the exact bottom of any market cycle, we have still been granted a unique opportunity to obtain “forever stocks” at historically low prices.

The deep and drastic dips of the stock market lead us into turbulent times. Investors tend to react and become ‘all in’ when the markets are having a bull run, and leap out, sitting in the sidelines while our emotions irrationally get the best of us when things are going poorly.

“Bull Markets are born on pessimism, grown on skepticism, mature on optimism, and die on euphoria. The time of maximum pessimism is the best time to buy.”

– Sir John Templeton

The MFA Prudent 10, a watchlist for potential investment, is designed to be the first step of our redeployment strategy into several sectors each hit differently by the current economic situation. These stocks are an average of 47% below their most recent 52-week high and are an average of 37% below their fair market value.

[one_fourth]

Company

Apple, Inc

Amazon

American Airlines

Boeing

Citibank

Disney

Square

Microsoft

PNC

Exxon

[/one_fourth]

[one_fourth]

Ticker

AAPL

AMZN

AAL

BA

C

DIS

SQ

MSFT

PNC

XOM

[/one_fourth]

[half last]

[/half]

* https://www.barrons.com/articles/barrons-100-most-influential-women-in-u-s-finance-clare-hart-51584709202, 22.March.2020

Disclosure:

McMahon Financial Advisors, LLC (“MFA Wealth” or the “Firm”) is an SEC registered investment adviser with its principal place of business in the Commonwealth of Pennsylvania. For information about the Firm’s registration status and business operations, please consult MFA Wealth’s Form ADV disclosure documents, the most recent versions of which are available on the SEC’s Investment Adviser Public Disclosure website at www.adviserinfo.sec.gov.

Investment Advisory Services offered through MFA Wealth. Insurance products offered through unaffiliated third- party insurance companies.

This content is provided by MFA Wealth for informational purposes only. Investing involves the risk of loss and investors should be prepared to bear potential losses. Past performance may not be indicative of future results and may have been impacted by events and economic conditions that will not prevail in the future. No portion of this commentary is to be construed as a solicitation to buy or sell a security or the provision of personalized investment, tax or legal advice. Certain information provided is derived from sources that MFA Wealth believes to be reliable; however, the Firm does not guarantee the accuracy or timeliness of such information and assumes no liability for any resulting damages.

Historical performance results for investment indices, benchmarks, and/or categories have been provided for general informational/comparison purposes only, and generally do not reflect the deduction of transaction and/or custodial charges, the deduction of an investment management fee, nor the impact of taxes, the incurrence of which would have the effect of decreasing historical performance results. It should not be assumed that your MFA account holdings correspond directly to any comparative indices or categories. Please Also Note: (1) performance results do not reflect the impact of taxes; (2) comparative benchmarks/indices may be more or less volatile than your MFA accounts; and, (3) a description of each comparative benchmark/index is available upon request.